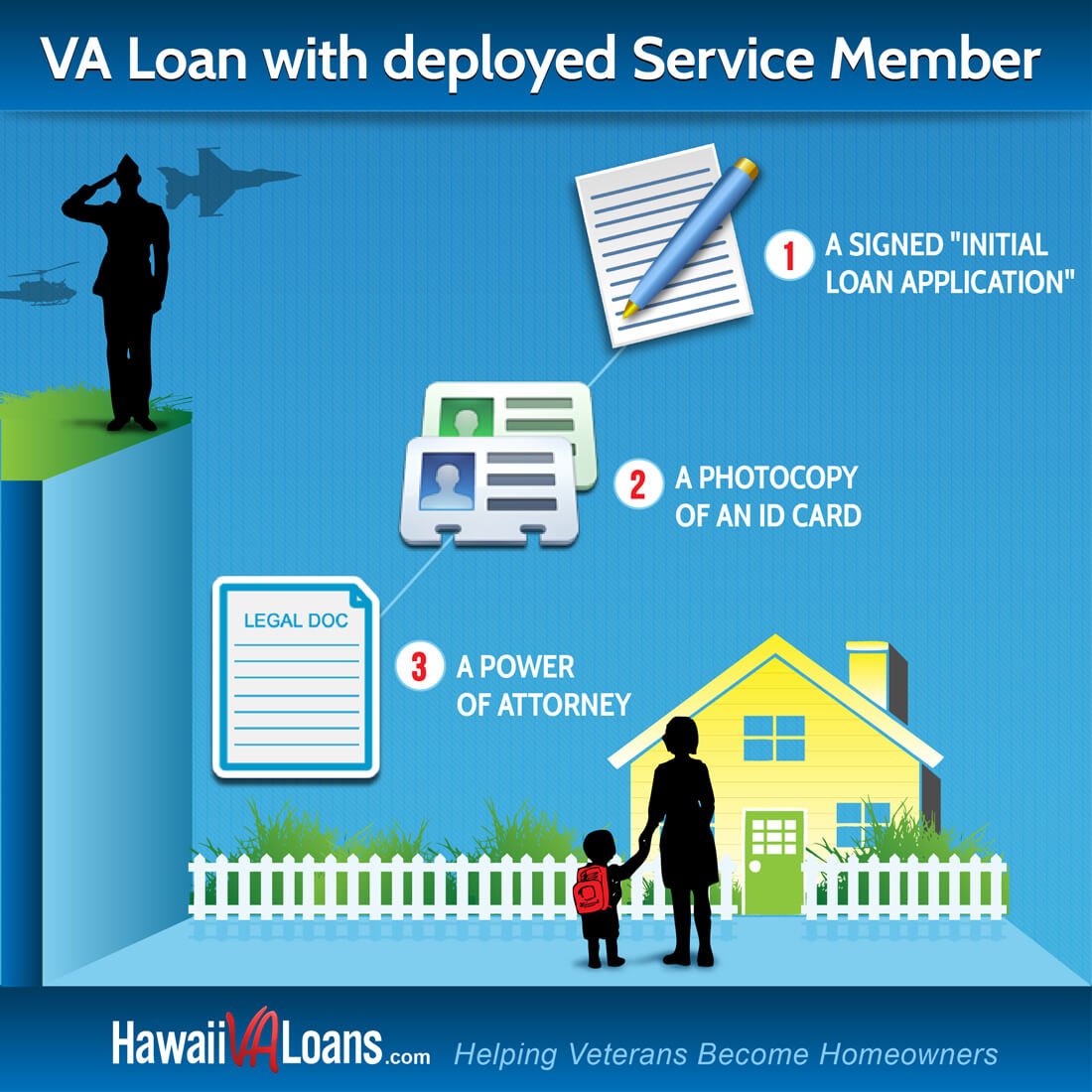

When purchasing a home in Hawaii with your VA Loan benefit, there are few steps added when your active duty spouse is deployed. One full signature, a copy of the deployed spouse’s drivers license or other ID, a perfect Power of Attorney, and a well-executed signature are all we need! Like many military spouses before you, Hawaii VA Loans is happy to help you smooth and complete that process for an even more special homecoming!

The Veterans Signature & ID

At the beginning of the loan process, it is important to have an original signature on your Initial Loan Application. Your VA Loan Specialist will provide you with the forms and envelope – it’s up to you to help us get the best address to which to send it off and away to! Often, we can email the form to your active duty partner, the military member then prints, signs, and mails it back to us in Hawaii. Luckily all other loan documents can be completed using your Special Power of Attorney for home buying. At the same time, obtaining a copy of the deployed spouse’s drivers license or other ID is also important so that we can complete the Patriot Act Customer Identification paperwork.

Getting a Power of Attorney

That Power of Attorney is one of the most important documents during the process, it’s important that it is in order. Full first, middle and last name are required for the deployed spouse on the Power of Attorney. It needs to state that the person named has the authority to buy and sell real estate, and be fully executed at the time of the loan. Later, you will sign all documents “Jane Activeduty by Joe Activeduty, attorney-in-fact” many, many times.

The Alive & Well Statement

The last extra on a VA Loan with a deployed service member is the Alive & Well statement. Before a service member deploys, it’s important to determine through the command if this statement will be signed by a Commanding Officer in the field or a rear detachment, in either case it must come in writing within three days of closing.

Understanding these small planning preparations will help your VA Loan with a deployed service member go even more smoothly. We at Hawaii VA Loans have assisted many military families in the home buying process with a deployed spouse, and are happy to answer any specific questions you may have about the process. If you’d like to find out how much you can qualify for on a VA Loan, fill out this online application, and we can let you know right away.