This is an age old question and actually quite complicated one (ok, maybe not quite age old, but common questions nonetheless). However, I will do my best to answer it as simply and accurately as possible. This is a slight oversimplification and this explanation may not apply to all mortgage rates, but it is the driving force behind the majority of rates (there are some lenders who set rates completely at their choosing, i.e credit unions, but they often base their rates off of other lenders’ rates which are described here). So, here it goes…

This is an age old question and actually quite complicated one (ok, maybe not quite age old, but common questions nonetheless). However, I will do my best to answer it as simply and accurately as possible. This is a slight oversimplification and this explanation may not apply to all mortgage rates, but it is the driving force behind the majority of rates (there are some lenders who set rates completely at their choosing, i.e credit unions, but they often base their rates off of other lenders’ rates which are described here). So, here it goes…

Mortgage rates, like stock prices are set by the open market. What does that mean? Well, it means that there isn’t someone sitting in a back room in Washington telling people what the rates are going to be. There are thousands of investors (mostly large banks, insurance companies and others) that buy and sell mortgage ‘securities’ every second the market is open. Whenever two agree on a price, that is the new market price. So…what are these securities? Lenders across the country sell individual loans to Fannie Mae and Freddie Mac. Fannie Mae and Freddie Mac, in turn give them back a security equal to the amount of loans sold to them. They also provide a guaranty that the principal (or the face value) of the security will be repaid. Because of this guaranty from Fannie Mae or Freddie Mac, investors are willing to buy these securities because they are now considered a safe investment. The buyer of the security does not need to worry if Joe in Detroit loses his job at the auto plant. Fannie and Freddie do that worrying for them and absorb any losses (I may describe that process in another blog post, but you’ve got enough to absorb within this one).

So, our lender now has a guaranteed security that he can sell on the open market. He looks to see the price that is being paid for such a security and knows exactly what he can sell it for, at that very second. Because there are so many transactions happening, these prices can change minute by minute, even second by second.

Of course if the lender waits until your loan closed, it is too late. So they will simply look at the market each morning to set the rates for new loans coming in. The market offers pricing for securities that will be sold at the end of this month, the next month, etc… Your lender watches the pricing throughout the day and usually keeps the available rates unchanged unless the market moves the price a lot.

But I am talking about price and not rates, how are they related? A lender will usually offer a range of rates. For example, 5.75%, 5.875% and 6.00%. Each of these can be sold in a security for a certain price. Each increase in rate will receive a higher price. If the lender can’t sell the loan at a high enough price to make their money back, they will require that a ‘discount’ point be paid by the borrower to make up the difference.

The Fed Funds Rate in Relation to Mortgage Rates

So, we now know that “The Fed” (personified by Ben Bernanke, and formerly Alan Greenspan) doesn’t set the rates directly, but I hear the Fed dropped rates to 1.50% recently, mortgage rates are at about 6.00%. Why are they so much higher? Good question, what the Fed controls is the supply of money available in the market for borrowing right now & for a very short time, typically overnight. So, if they are lending overnight, they will get paid back tomorrow. The risk of inflation and other long term economic factors changing is very low. However, when an investor buys a mortgage backed security, they don’t expect to get paid back completely for at least seven years or more. In those seven years, a lot can happen. Inflation can go up, interest rates as a whole can go up, there are many factors that can affect the value of that security.

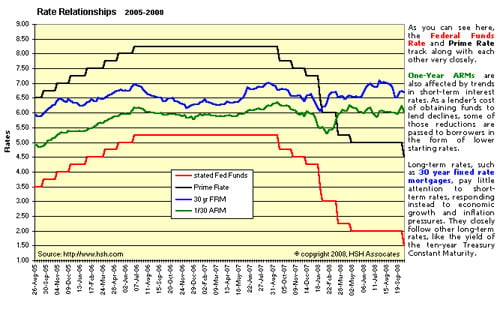

Let’s just use an extreme example an investment company buys a mortgage security that pays 6.00% and five years later rates have skyrocketed to 11%. Who wants to own something paying 6% when they could easily get something that pays them almost twice as much? No one, and that is the risk that you have when buying a mortgage security. The risk that comes from that increased timeframe is the reason the rate is so much higher than an overnight loan (the Fed Funds rate). The following graph shows the relationship between the Fed Funds rate and mortgage rates over the past several years.

As you can see – over the past few years when the Fed has lowered or increased the Fed Funds rate, the 30 year mortgage rates did not rise or fall accordingly. I hope this clears things up a bit. Please let us know if you have any questions that we can help you answer.

As you can see – over the past few years when the Fed has lowered or increased the Fed Funds rate, the 30 year mortgage rates did not rise or fall accordingly. I hope this clears things up a bit. Please let us know if you have any questions that we can help you answer.