“What interest rate can you offer me?” Ask any mortgage loan officer and they will tell you that this is probably the first and most commonly asked question they get from their customers. Rightfully so, since the interest rate determines what your mortgage payment will be and, of course, we all want the lowest payment possible.

“What interest rate can you offer me?” Ask any mortgage loan officer and they will tell you that this is probably the first and most commonly asked question they get from their customers. Rightfully so, since the interest rate determines what your mortgage payment will be and, of course, we all want the lowest payment possible.

Now, this is a loaded question because one’s interest rate depends on many factors like down payment, equity in the home, credit score, property type and when you actually lock in the rate (here’s an old post we wrote on what determines mortgage rates). Another important factor is the type of loan program you are using – a Conforming loan (a mortgage which the meets the underwriting requirements of Fannie Mae or Freddie Mac – and is most likely sold to them) or a Government loan (mortgage guaranteed by the government, most typically an FHA or VA loan).

An important thing to clarify is that Conforming mortgages and Government mortgages have different “base rates”. You can think of a base rate as the interest rate prior to any “add-ons” or “adjustments” which are added to the rate to account for certain characteristics and/or risk factors of that particular loan.

Traditionally, a Conforming loan base rate will be roughly an eighth to a quarter percent better than a Government loan base rate. The one big difference is that Government loans do not implement Loan Level Price Adjustments (LLPA’s) like Conforming loans do. What does this mean for prospective home buyers or homeowners who would like to refinance? If you don’t have at least a 740 credit score as well as a 25% down payment (or 25% in equity – for a refinance) and you are getting your mortgage through a Conforming loan, your interest rate will be higher than the base rate being advertised.

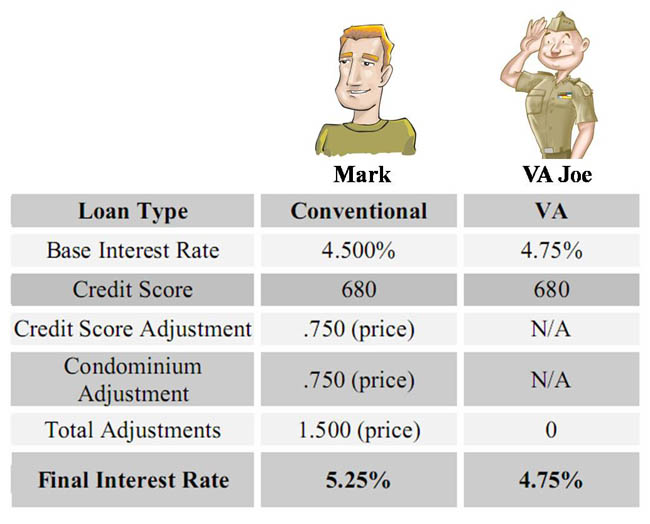

To illustrate my point, let’s take a look at two potential home buyers who are looking to purchase a condominium. Now, Mark and VA Joe have the same income, assets and credit score (680) and both will be making a 10% down payment. The only difference is that Mark is purchasing using a Conforming loan and VA Joe with a VA loan.

As you can see by the illustration above – Mark’s base rate is a quarter percent better than VA Joe’s, but because of the Loan Level Price Adjustments on Conforming loans, there is an add-on for Mark’s credit score as well as property type (condominium). These adjustments are called “price adjustments” which will either translate into higher closing costs (if Mark wants to keep the base rate) or an increase in the interest rate, as seen in this example.

Here’s the most recent Loan Level Price Adjustment Matrix from Fannie Mae to give you an idea of the different types of risk factors that translate into in increase in interest rate and/or closing costs for a Conforming mortgage.

Bottom line, unless you are buying a Single-Family Dwelling (SFD), have at least a 25% down payment and a credit score above 740 – it is more than likely that you’ll get a better interest rate through a Government-backed mortgage, like FHA or VA, compared to a Conforming mortgage.