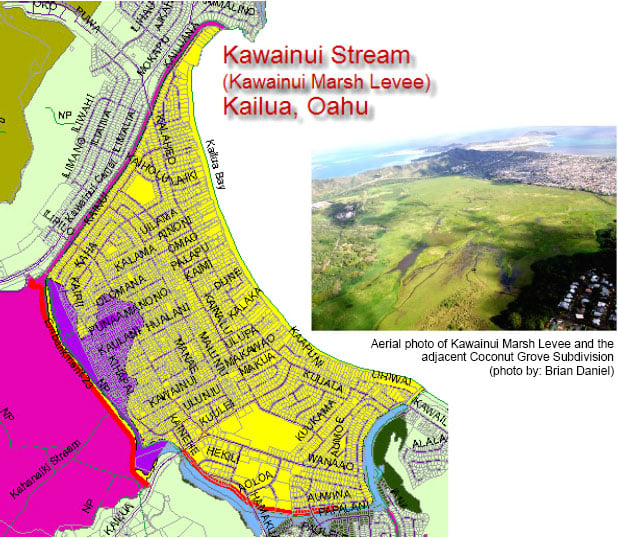

I am sure you all are aware of Hurricane Katrina, yes, that’s right, the awful mess we all saw unfold on national TV. I was astounded that a disaster so atrocious could be happening in our great country. Well, believe it or not, we are going to feel its effect all the way out here in the Pacific…and years later. What do I mean? Well, ever since those levees in New Orleans broke, the government is determined not to let that happen again. To ensure that cities, counties and towns take action, every levee in the country must be accredited or re-accredited by February 1, 2010. If a levee is not accredited, then flood maps will be redrawn and affected areas re-zoned. We have ten such levees here in Hawaii, but none will have a greater affect on its surrounding residents than the Kawainui Marsh Levee in Kailua. Here’s the bottom line, if this Levee is not certified in time, the whole Coconut Grove area of Kailua will be re-zoned to the highest risk flood zone and flood insurance will be required by lenders on any financed house in that area.

I am sure you all are aware of Hurricane Katrina, yes, that’s right, the awful mess we all saw unfold on national TV. I was astounded that a disaster so atrocious could be happening in our great country. Well, believe it or not, we are going to feel its effect all the way out here in the Pacific…and years later. What do I mean? Well, ever since those levees in New Orleans broke, the government is determined not to let that happen again. To ensure that cities, counties and towns take action, every levee in the country must be accredited or re-accredited by February 1, 2010. If a levee is not accredited, then flood maps will be redrawn and affected areas re-zoned. We have ten such levees here in Hawaii, but none will have a greater affect on its surrounding residents than the Kawainui Marsh Levee in Kailua. Here’s the bottom line, if this Levee is not certified in time, the whole Coconut Grove area of Kailua will be re-zoned to the highest risk flood zone and flood insurance will be required by lenders on any financed house in that area.

The Dilemma

The levee was built relatively recently, so that just means we have to get it accredited in time. This shouldn’t be a big deal, right? I did some digging to find out, and here’s my understanding of the issue thus far…

I was able to contact the City & County NFIP (National Flood Insurance Program) Coordinator and he provided me a good overview of what’s happening.

1) In preparation for the deadline, the City & County first had to determine which would be the best organization to prepare the levee certification report and documentation. The Army Corps of Engineers designed and built the levee, so it was determined that they would be the most appropriate body to perform the work.

2) However, in order for the corps to be engaged in the project, both the City & County and the Federal Government have to put up matching funds, sounds easy enough, right. How much could this cost anyway? This is where it gets tricky. The C&C has appropriated funds…excellent : ), but hasn’t yet been able to secure the matching federal funds. The amount is relatively small ($30,000), but without it, the levee will not be able to be accredited. The C&C has tried contacting Senator Inouye, but to no avail at this point.

3) FEMA has a deadline of February 1, 2010 for the accreditation package to be turned in. At that point, if the necessary documentation is not turned in (or the levee is not shown to comply with the regulations), the re-mapping process will begin. If the C&C can provide proper documentation before the new map revision goes into effect (to show the levee can be accredited), then the re-mapping can be put on hold. Because of the time needed for FEMA to review all the claims from across the country, the C&C NFIP estimates that there is about a one year window between the February deadline and the remapping. So, the levee certification package will need to be completed within that time period.

Based on our brief conversation, it didn’t sound like they had been making much progress with Inouye’s office, but he didn’t expand on that too much.

Taking Action

I put a call in to Mazie Hirono’s office, the person that I spoke with was unaware of the issue, but was going to escalate the issue and have someone give me a call. That was late last week, but I haven’t received a call yet, so my guess is that it isn’t high on the radar despite the fact that it will affect several hundred homes at the very least.

I am assuming at this point, that none of our representatives on Capitol Hill are actively working on the issue nor do I believe they are aware of it.

As for what we can do, I suspect the best course of action would be any push to raise awareness of the issue to our representatives in congress. Hopefully I hear back from Representative Hirono’s office and they’ll have some advice as well.

For those of you ready to concede, there is a way to sneak in ahead of the new Flood Insurance Rate Changes. It is called, “Grandfathering” and here’s how it works in this situation. The National Flood Insurance Program has “grandfathering” rules to recognize policyholders who built in compliance with the flood map in effect at the time of construction or who maintain continuous coverage (http://www.floodsmart.gov/floodsmart/pages/flooding_flood_risks/grandfathering.jsp). So, if you own in that area, it may be time to obtain flood insurance now, while you are not considered to be in a ‘high risk’ flood zone. Soon you may be.

The Math

Higher Flood Zone = Higher Costs for Homeowners > Increased Rents > Less Money for Kailua Residents > Decreased Home Values.

It appears that the new annual premium will be $1634 – about $140 a month (building only coverage for the maximum of $250K, no contents). Let’s see…by looking at the expected flood map revisions, all of Coconut Grove will be affected. My first guess was that about 300 houses would be affected, but then I had the brilliant idea to take a look at Google Earth and it looks like there are easily 1000 homes that would now be classified as high risk flood zones. Now, let’s do some simple math. What is 1000 times $1634? Hmmm, that’s about $1.6 million cost to homeowners in the first year!!!!! Not to mention that the additional cost for flood insurance will make it more expensive to live in Coconut Grove – which of course will affect overall values in this area ($140/month in additional cost translates to roughly $25,000 in buying power).? So…let’s contact Hirono, Inouye and Akaka, send them a link to this blog post and ask them to find the $30K we need to get this fixed