How do we determine a borrower’s VA loan pre-approval amount? By looking at finances of course! Before we get into when a Budget Letter may be required for VA loan pre-approval, let’s go over how the process starts.

The VA Loan Process begins with getting prequalified. Prequalification involves a 15 minute phone call or in-person meeting. During the meeting, a VA Loan Specialist will give the potential buyer an estimated affordable home price. This amount is based on verbal information from the buyer about income and debts.

Next is the more official and necessary step of pre-approval. A VA Loan Specialist will request the following documents for pre-approval:

- Most recent LES or Pay Stubs (one month)

- Last 2 years W2 statements

- Last 2 years Federal Tax Returns

- Last 2 months Bank Statements

- Certificate of Eligibility

From there, an accurate pre-approval amount will be determined. Once that amount is known, the VA buyer can home shop with confidence.

The Budget Letter

Now, there are some circumstances that may require a Budget Letter to be completed by the borrower prior to getting officially pre-approved. These instances are:

- High Debt-to-Income (DTI) Ratio and Payment Shock

- Payment Shock occurs when, rather suddenly, someone is obligated to pay more in monthly debt than they can afford from their income.

- High DTI and Low Reserves

- Reserves are savings balances that will be there after you close on your home.

- Unstable Work History

The underwriter will request a Budget Letter from the borrower if any of these factors are seen. An underwriter evaluates credit history, assets, the size of the loan requested and how well they anticipate that the borrower can pay back the loan.

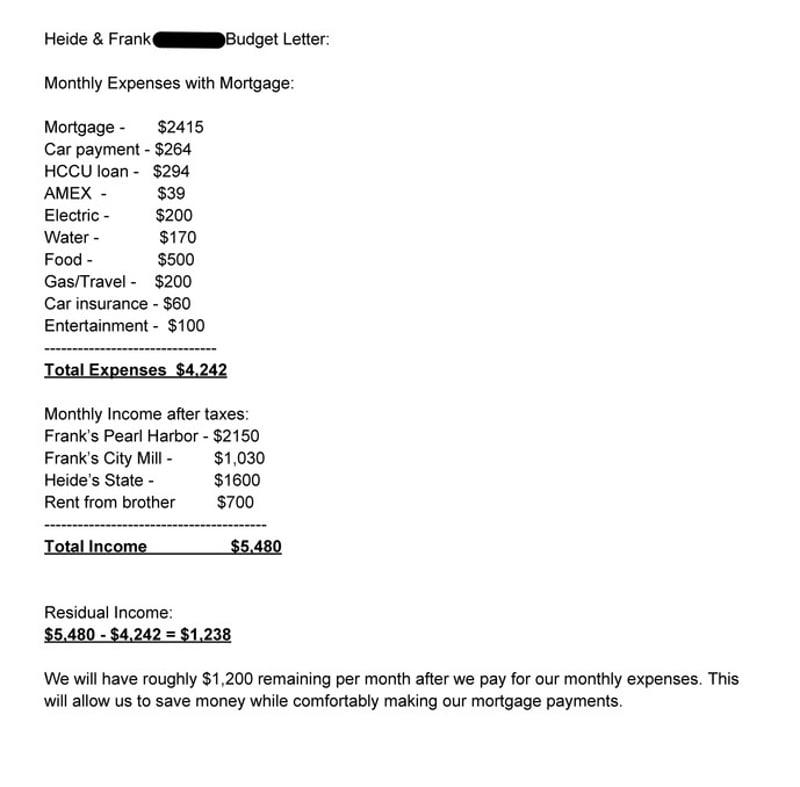

An Example of a Budget Letter:

A Budget Letter is helpful because it shows the lender and the borrower how comfortable making their monthly mortgage payment will be.

Compensating Factors

Indeed, there are some strong compensating factors that prevent the underwriter from asking for a Budget Letter. Compensating factors are positive aspects of a borrower’s loan application that help offset the negative such as bad credit or low income.

They are:

- Low use of consumer credit (unsecured loans)

- Ability to save consistently

- Strong reserves

- A spouse with significant earning potential that isn’t on the loan

It’s important to know that a Budget Letter is requested to ensure a wise financial decision for a buyer. The VA home loan program seeks to protect servicemembers and Veterans from entering into a situation that can cause financial distress. Therefore, Hawaii VA Loans works with our borrowers to ensure that VA home buying is a successful endeavor.

Contact us to get pre-approved for your VA home loan or fill out our online application to get started now.