Typically, lenders analyze a borrower’s Debt-to-Income (DTI) ratio as the primary factor to determine a borrower’s ability to repay and therefore, qualify for a home loan. DTI is a ratio that counts your minimum monthly debt obligations (what’s included on your credit report) plus your expected housing expense, divided by your gross monthly income.

DTI = Monthly Debt Obligations + Expected Monthly Housing Expense / Gross Monthly income

For conforming loans, the most common loan program used today, a borrower is limited to a 45% DTI. This can be somewhat restrictive considering the home prices here in Hawaii. For a VA loan, the maximum DTI ratio is only 41%, but thankfully, there is an exception process available to help veterans who need to exceed this ratio to buy a home.

The VA loan program gives a veteran the ability to qualify with a DTI that exceeds the 41% limit (and even exceed the 45% DTI max allowed by a conforming loan) as long as the veteran’s Residual Income meets the required threshold determined by the VA Department based on the household size.

Wait, what? Don’t worry, let me explain and break it down for you.

What Is Residual Income?

Residual income, also known as “discretionary income” is a calculation of the amount of money remaining (after taxes and loan payments) to cover basic needs such as food, clothing, gas, healthcare and other family expenses. While DTIs take into account all expenses that appear on a borrower’s credit report, the residual income calculation goes a step further. It takes into account expenses such as income taxes, mandatory retirement deductions (social security) and miscellaneous home expenses such as maintenance and utilities in order to get a realistic calculation of how much discretionary money the veteran will have each month.

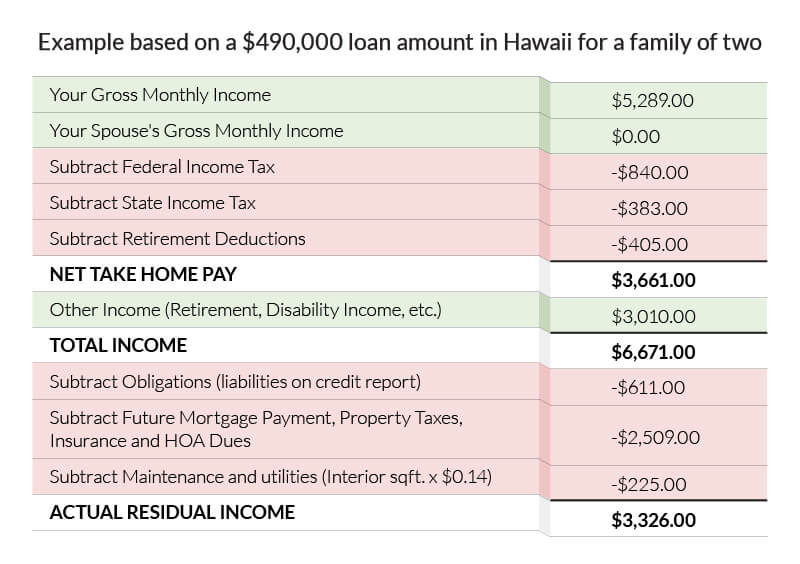

Residual Income Calculation Example

In this scenario, the veteran has a loan amount of $490,000 at 3.625% (APR 3.717%) and has a household size of two (the veteran and spouse). The veteran’s residual income would need to be higher than the amounts indicated below based on household size (applicable for homes in the West Region which includes Hawaii):

In this scenario, the veteran has a loan amount of $490,000 at 3.625% (APR 3.717%) and has a household size of two (the veteran and spouse). The veteran’s residual income would need to be higher than the amounts indicated below based on household size (applicable for homes in the West Region which includes Hawaii):

- Family size of 1 = $491

- Family size of 2 = $823

- Family size of 3 = $990

- Family size of 4 = $1,117

- Family size of 5 = $1,158

- Over 5 = Add $80 for each additional member up to a family of seven

In the above scenario, the veteran’s $3,326 in residual income easily meets the threshold of $823 for a family of two provided by the VA Department. In this case, thanks to the excess discretionary income available to the veteran, they are allowed to have a debt-to-income ratio above the 41%. In certain cases, this ratio can even exceed 50% depending on other compensating factors such as credit score, money in the bank, stable work history, etc.

As you can see, the VA loan program gives veterans every opportunity to own their own home, thanks to the flexibility allowed within the guidelines. To find out how you can qualify for a VA loan, contact us at 808-792-4251 or simply fill out our secured online loan application and a member of our team will get back to you!