Having little to no money in the bank can be one of the main deterrents to homeownership. In this case, the logical option would be to rent since it would be less cost upfront, right? Well, if you are eligible for a VA Loan, this may not be necessarily true. Let’s do the math!

Meet Cindy, Joe & Mark

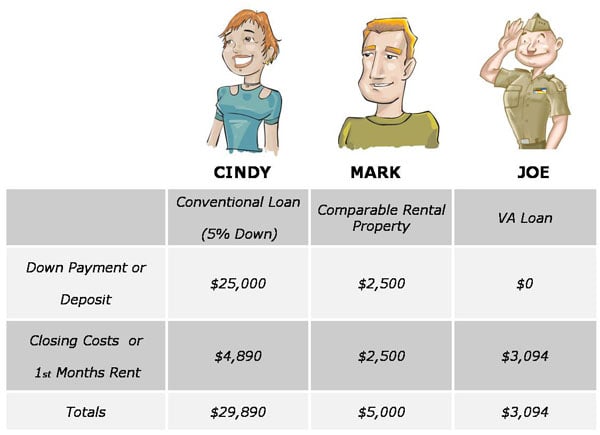

Cindy & Joe are both looking to buy a $500,000 property. Joe is eligible to finance the purchase through a VA Loan. Cindy on the other hand is not VA eligible, and will purchase via a conventional mortgage.

Now Mark is eligible for a VA Loan but feels like he can’t afford the upfront costs of buying a home right now, so he’s looking to rent. He’s looking to rent a home for about $2500, which is comparable to the $500,000 property that Cindy & Joe want to purchase (see rentometer.com).

Down Payment / Deposit

Since Joe is doing a VA Loan – he is not required to put a down payment, but Cindy at the very least needs to put 5% down or $25,000 for a conventional mortgage. Mark doesn’t need to make a down payment but, unless he’s renting from family, he’s going to have to put a security deposit which is usually equivalent to first month’s rent or $2500.

Closing Costs / 1st Months Rent

It’s now October and Mark is looking to move into his property on November 1st – which means on top of his security deposit ($2500) he will also need to pay the first months rent ($2500) for a total of $5,000 before moving in.

As for Cindy & Joe, they would both have to pay closing costs for their purchase. Now assuming that they both did not receive any sort of closing credit or do not plan on paying points to buy down their rate Cindy & Joe would still have some basic closing costs to pay. Based on the loan amount, the estimated amount Cindy would have to pay for closing costs would be around $4890. Since Joe is using a VA loan to finance his purchase and VA has reduced closing costs, he’s estimated to only pay $3,094.

In addition, if Cindy & Joe were to close in October, their first mortgage payment would not be in November, it would actually be in December. Based on this information, let’s take a look at Cindy, Joe & Mark’s upfront out-of-pocket expense:

Conclusion

Since you’re not required to put a down payment on VA Loans, and you have reduced closing costs, it is more than likely that your upfront out-of-pocket costs for buying a home will be cheaper than renting a home. Please keep in mind that numbers may differ depending on different variables – but this should give you a better idea of your options if you are eligible for a VA Loan.